LSD: Liquid Staking Derivative

Introduction

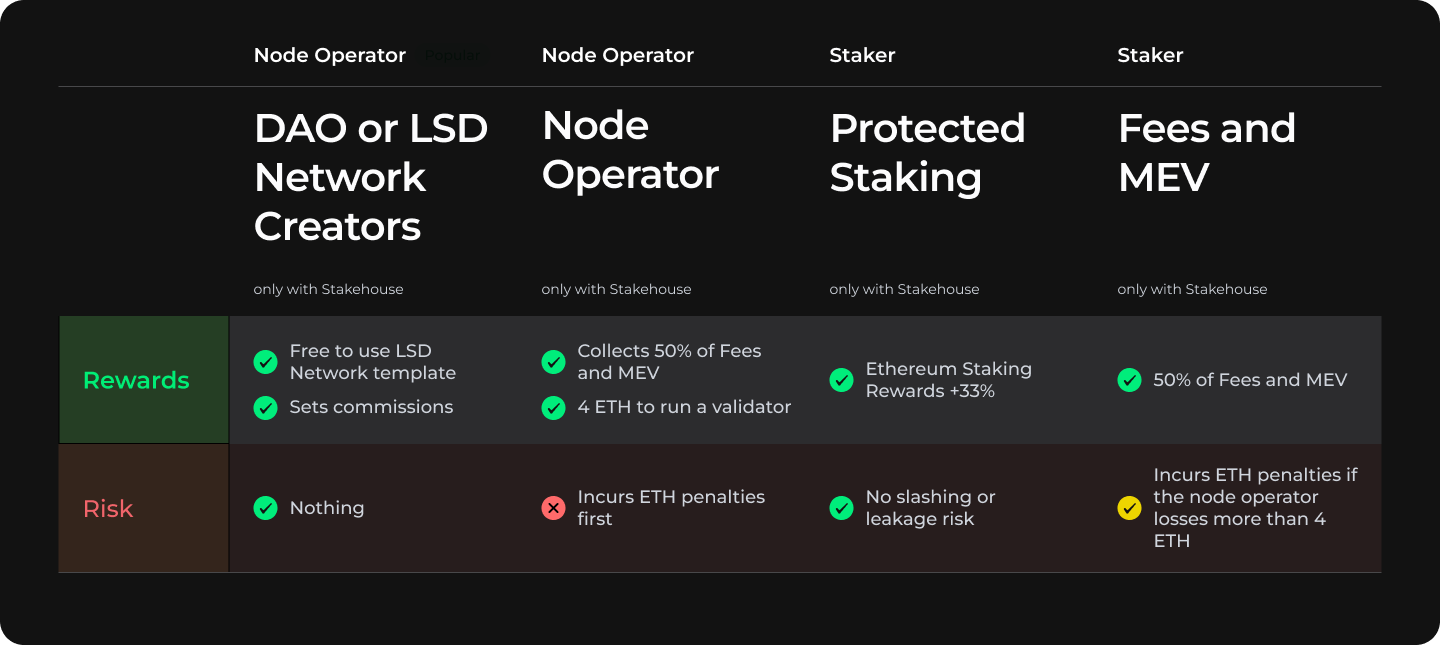

Liquid Staking Derivative (LSD) Network is an opportunity to connect liquidity to node operators, built on top of the Stakehouse Protocol. It allows anyone to deploy their own Liquid Staking network where all network participants hold a fractional ownership of a validator on Ethereum. Users can run a validator for 4 ETH or provide liquidity, as little as 0.001 ETH, to earn Ethereum consensus rewards and Ethereum cash flow. Using LSD Networks, anyone can deploy as many LSD Networks as they want. The users of LSD Networks can range from DAOs to node operators to general users who have ETH to stake.

LSD users require little knowledge of the Stakehouse Protocol, but more information can be found here.

LSD Networks can be deployed by any Ethereum account which could be a DAO, Gnosis safe, etc. The deployment requires no ETH apart from the gas required for deploying the contracts. Whilst the Ethereum deposit contract still requires 32 ETH to set up a validator, LSD contracts reduce that capital barrier amongst multiple participants that want shared validator ownership and a pro-rata share of revenue. We call this the 3 pool strategy or 4 + 4 + 24. 24 ETH can be crowdsourced for protected deposits. 4 ETH must be supplied by a node operator that will receive 50% of network revenue of their validator and finally the last 4 ETH can be crowdsourced into the MEV Staking pool to get a pro-rata share of the other 50% of network revenue. When the 32 ETH is collected, it can be used to stake the validator using the Ethereum Foundation's deposit contract.

These user groups can be categorized into: