Fees & MEV Portfolio

MEV Staking Portfolio

The MEV Staking Portfolio provides in-depth information about the status and performance of a user’s MEV Staking position. This information is delivered in three sections, providing users with the necessary capabilities for multi-scope analysis. The three sections of information are as follows. (To learn more about MEV Staking, please go here)

MEV Staking Dashboard

At the top of the page, users can view the MEV Staking dashboard. This dashboard contains three sections of information about the status and performance of the user’s MEV Staking position. The key information provided includes:

Total Rewards Earned - The aggregate amount of ETH rewards earned over the lifetime of the user’s MEV Staking position. This metric does not change when the user claims ETH rewards.

Assets - The amount of ETH deposited and staked in the MEV Staking pool. Deposited ETH sits in the Giant Pool until it is paired with and staked in a validator. Once this happens, it becomes Staked ETH.

Portfolio Details:

LSD Networks - The number of LSD Networks in which the user’s ETH is staked.

Validators - The number of validators in which the user’s ETH is staked.

Payoff Rate - The ratio of the redemption rate against the exchange rate. This represents how many SLOT tokens have been slashed without being topped up.

Payoff Rate = Redemption Rate / Live Rate.

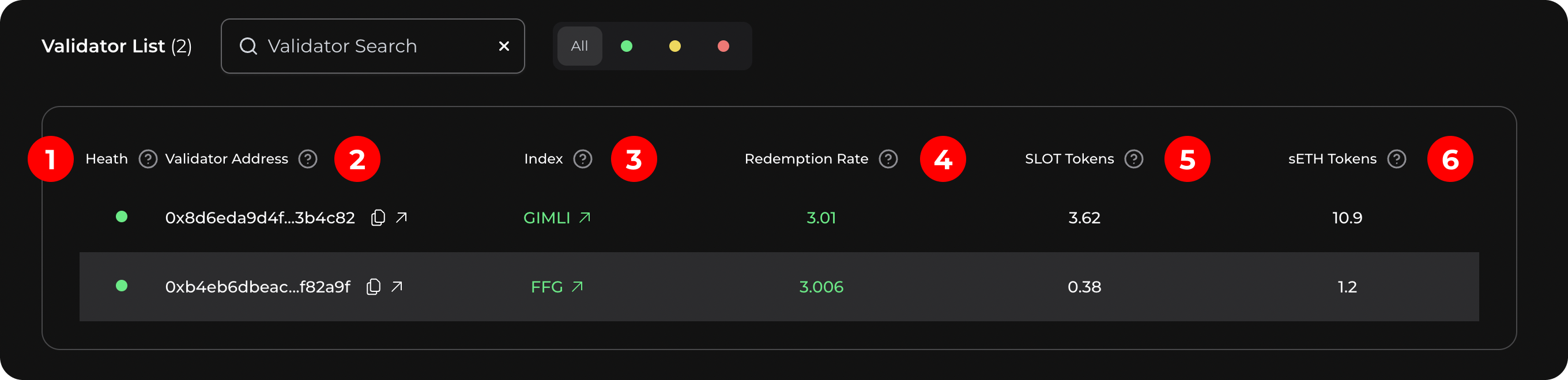

Validator List

The Validator List provides basic performance information about each of the validators in which the user’s ETH is staked (MEV Staking). Since the user may have ETH staked in multiple validators, it’s helpful for them to have comparative visibility into each of the validators. The information provided by the Validator List is displayed as follows:

Health Status - The overall health indicator for a validator. Users can use this metric to determine which validators need priority attention and corrective action.

- Green= Nominal.

- Yellow= Needs attention.

- Red= Issue.

Validator Address - The validator’s public key.

Index - The LSD Network in which the validator is a part of.

Redemption Rate - The amount of sETH required to burn per SLOT token in the LSD Network to remove the validator. In other words, it represents delta increase against the exchange rate when there is leakage.

Redemption Rate = Total dETH minted in-house / (Total SLOT in-house - Total SLOT slashed at house level).

SLOT Tokens - The amount of SLOT tokens the user owns from the validator. SLOT is the accounting token for staked ETH on the consensus layer. SLOT token ownership allows users to earn MEV and Tips revenue generated by the validator in which their ETH is staked.

sETH Tokens - The amount of sETH the user holds in their wallet. sETH is a liquid token that users hold in their wallets in representation of their SLOT token ownership. The ratio of sETH to SLOT is 3:1 respectively.

Validator Snapshots

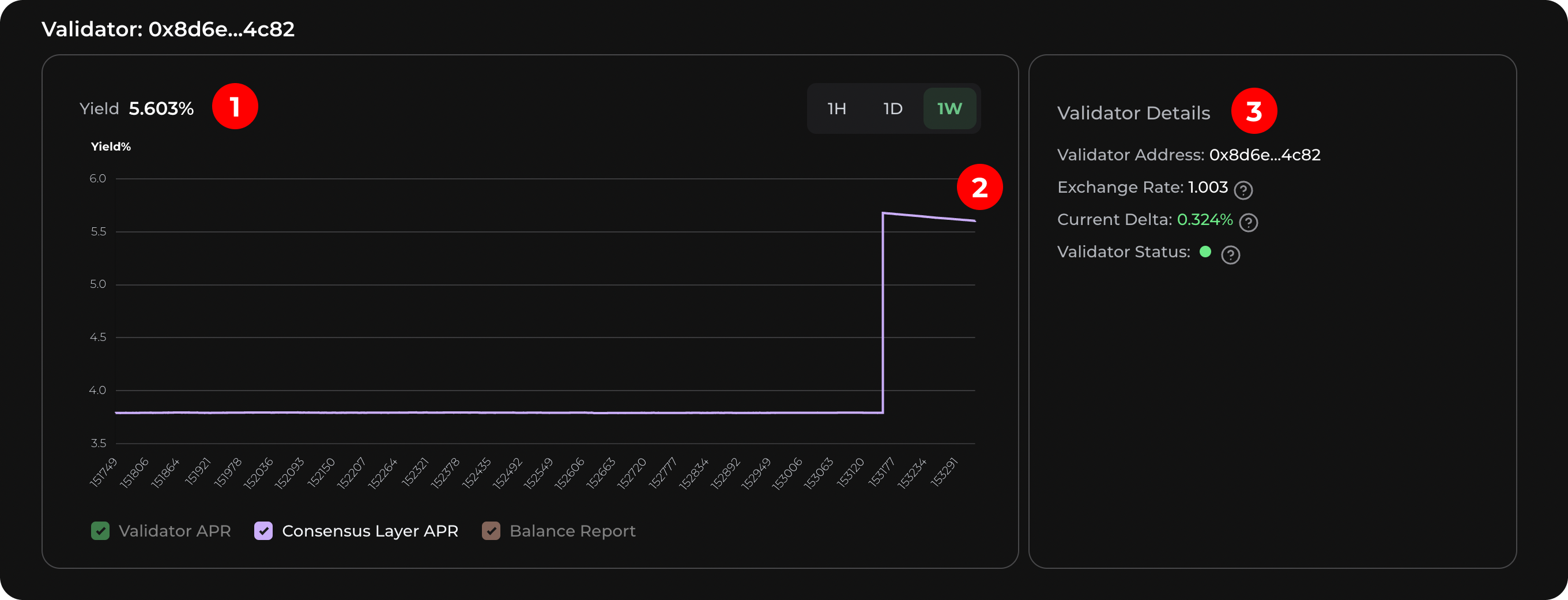

The Validator Snapshots provide in-depth information about each of the validators in the Validator List. This level of scope provides users with a granular view into the status and performance of each individual validator in which their ETH is staked. The information on each of the snapshot dashboards is displayed as follows:

Validator Yield Rate - This displays the APR of dETH within the validator. This is a key metric for monitoring a validator’s yield performance and is updated at the time of a Balance Report.

Validator Yield Rate Chart - The charting tool that displays a validator’s current and past APR, consensus layer APR, and Balance Report dates. This chart is very useful for users who prefer a visual display of their validator’s yield performance over time (it can be viewed in hourly, daily, and weekly timeframes). The interactive boxes at the bottom of the chart allow users to view the validator’s APR, consensus layer APR, and balance report dates individually or simultaneously. This provides a multi-layer scope for comparative analysis.

Validator Details:

Validator Address - The validator’s public key.

Exchange Rate - The sum of dETH earned plus the initial 24 dETH balance divided by the initial 24 dETH balance. The exchange rate should never go down.

Current Delta - The validator’s current yield rate compared with the yield from its last Balance Report. Positive numbers mean the validator is yielding at a higher rate than the last reported balance. 0 means that the validator hasn’t earned anything since the last balance report.

Validator Health Status - The metric that shows whether the validator is eligible for Ethereum Rewards or not. If the validator status is yellow or red, then it is possible to top up the validator and acquire validator specific SLOT tokens.

- Green= The effective balance is 32 and the active balance is more than 32.

- Yellow= The effective balance is 32 and the active balance between 32 and 31.75.

- Red= The effective balance is less than 32.