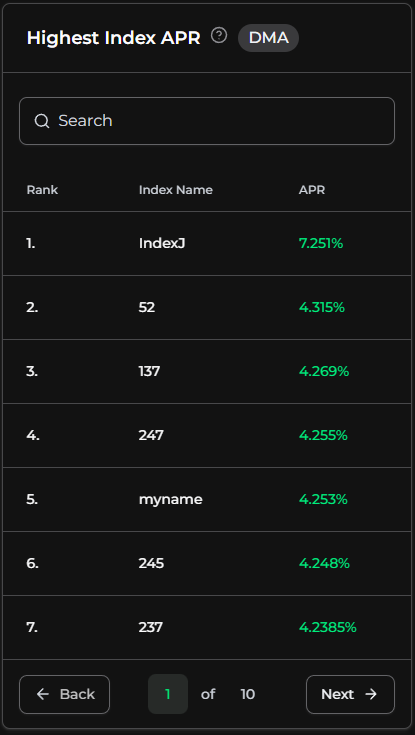

Highest Index APR

The Highest Index APR (Annual Percentage Rate) chart breaks down indexes that are the best performing in terms of dETH yield across the Stakehouse protocol. The chart shows which indexes average the highest yield based on all the validators within an index. The indexes consist of validators that all have varying performances. Some could generate very high yields, while others could generate very low ones. The Index APR is the aggregate yield of all the validators in the index divided by the number of validators. This means that although an index could be one of the highest yields, there might still be room for improvement in a validator.

The Highest Index APR is calculated as follows. Firstly, Stakehouse sums the individual validator's APR for a selected index in a moving 7-day period calculated once per day. Then, the summed APR is divided by the total number of validators in that index. Finally, based on yield output, rankings are assigned in descending order of highest average APR.

The highest-performing indexes will provide users the opportunity to see which indexes are able to consistently output high dETH yield and create strategies to mirror those results.