Protected Staking Portfolio

Protected Staking Portfolio

The Protected Staking Portfolio provides in-depth information about the status and performance of a user’s Protected Staking position. This information is delivered in three sections, providing users with the necessary capabilities for multi-scope analysis. The three sections of information are as follows. (To learn more about Protected Staking, please go here)

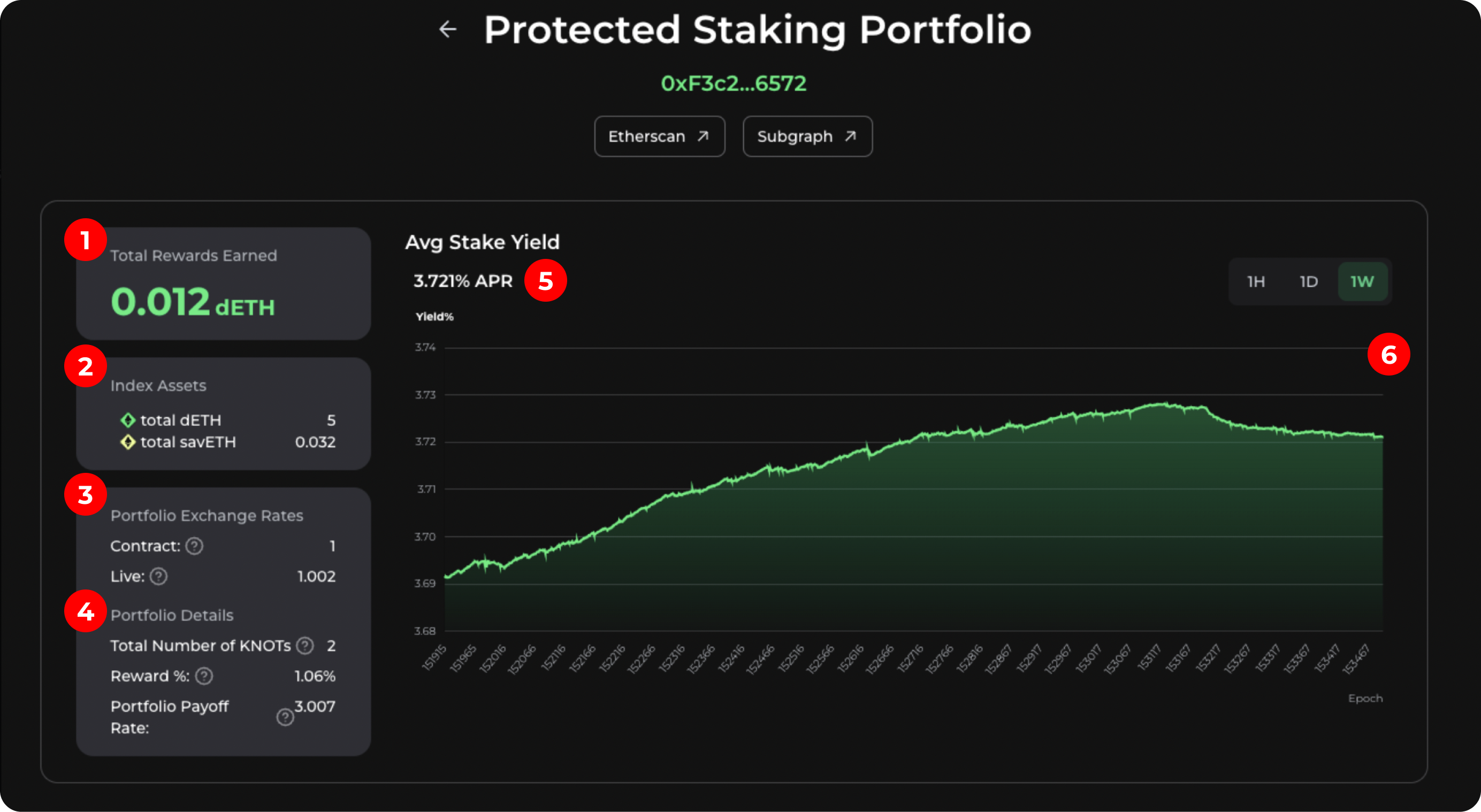

Protected Staking Dashboard

At the top of the page, users can view the Protected Staking dashboard. This dashboard provides overview information about the status and performance of the user’s Protected Staking position. The key information provided includes:

Total Rewards Earned - The aggregate amount of dETH rewards earned over the lifetime of the user’s Protected Staking position. This metric does not change when the user claims dETH rewards.

Assets - The amount of dETH and savETH the user owns. savETH is the consensus layer accounting token for dETH. The ratio of savETH to dETH is 1:1 respectively.

Portfolio Exchange Rates:

Contract Rate - The sum of dETH earned plus the initial 24 dETH balance divided by the initial 24 dETH balance. This is based on the most recent Balance Report. This metric is helpful because it indicates the amount of dETH the user has yielded.

Contract Rate = (dETH Earned + 24) / 24 (based on last Balance Report)

Live Rate - The sum of dETH earned plus the initial 24 dETH balance divided by the initial 24 dETH balance. This is in reference to the consensus layer APR. This metric is helpful because it indicates the amount of dETH the user has yielded.

Live Rate = (dETH Earned + 24) / 24 (based on consensus layer APR)

Portfolio Details:

Total Number of KNOTs - The number of validators in which your ETH is staked.

Reward Percentage - The percentage of profit returns the user has made on their staked position in terms of their initial investment. This takes into account the earnings accrued by all the validators in which the user’s ETH is staked. This metric only applies to staking rewards.

Profit Percentage = Profit Earned / Principal Investment.

Portfolio Payoff Rate - The average payoff rate of each validator considering its SLOT tokens, slashings, and top ups.

Portfolio Payoff Rate = Live Rate / Redemption Rate.

Portfolio Yield Rate (APR) - The current annual percentage rate at which your staked ETH is earning staking rewards. This metric allows users to monitor and track the yield performance of their staked position at any moment in time.

Yield Rate Chart - The charting tool that displays yield over time for the user’s staked position. This chart can be viewed in hourly, daily, and weekly timeframes. This feature is extremely useful because it allows users to compare their staked position’s yield performance over different points in time.

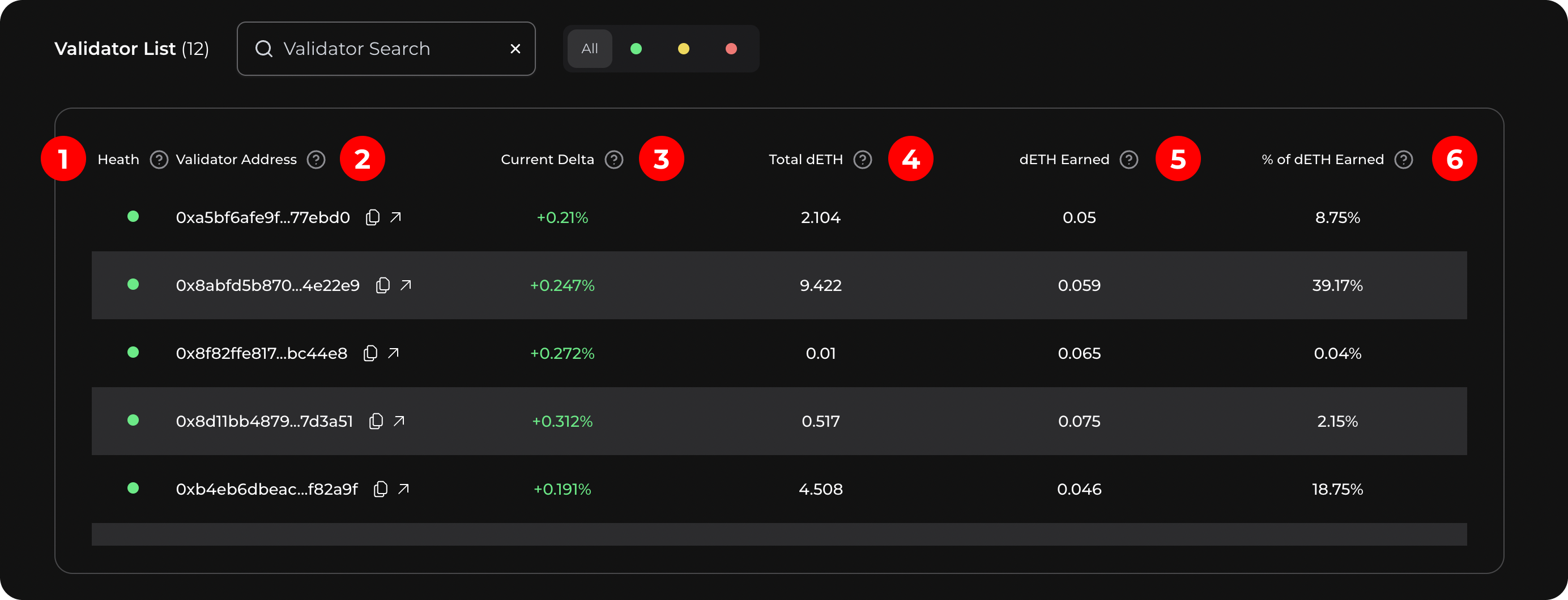

Validator List

The Validator List provides basic performance information about each of the validators in which the user’s ETH is staked (Protected Stake). Since the user may have ETH staked in multiple validators, it’s helpful for them to have comparative visibility into each of the validators. The information provided by the Validator List is displayed as follows:

Health Status - The overall health indicator for a validator. Users can use this metric to determine which validators need priority attention and corrective action.

- Green= Nominal.

- Yellow= Needs attention.

- Red= Issue.

Validator Address - The validator’s public key.

LSD Index - The LSD Network in which the validator is a part of.

Current Delta - The real-time difference between the validator’s contract yield rate and live yield rate. Users can initiate a Balance Report from the Stakehouse dApp to update the Current Delta.

dETH Earned - The total amount of dETH earned by the validator. Users can compare this metric across the validators in the list to identify which validators have produced the most yield thus far.

Percent of dETH Earned - The percentage of dETH earned by the validator respective to the user’s portfolio. Users can compare this metric across the validators in the list to determine how much of an impact each validator has on their Protected Staking position’s yield.

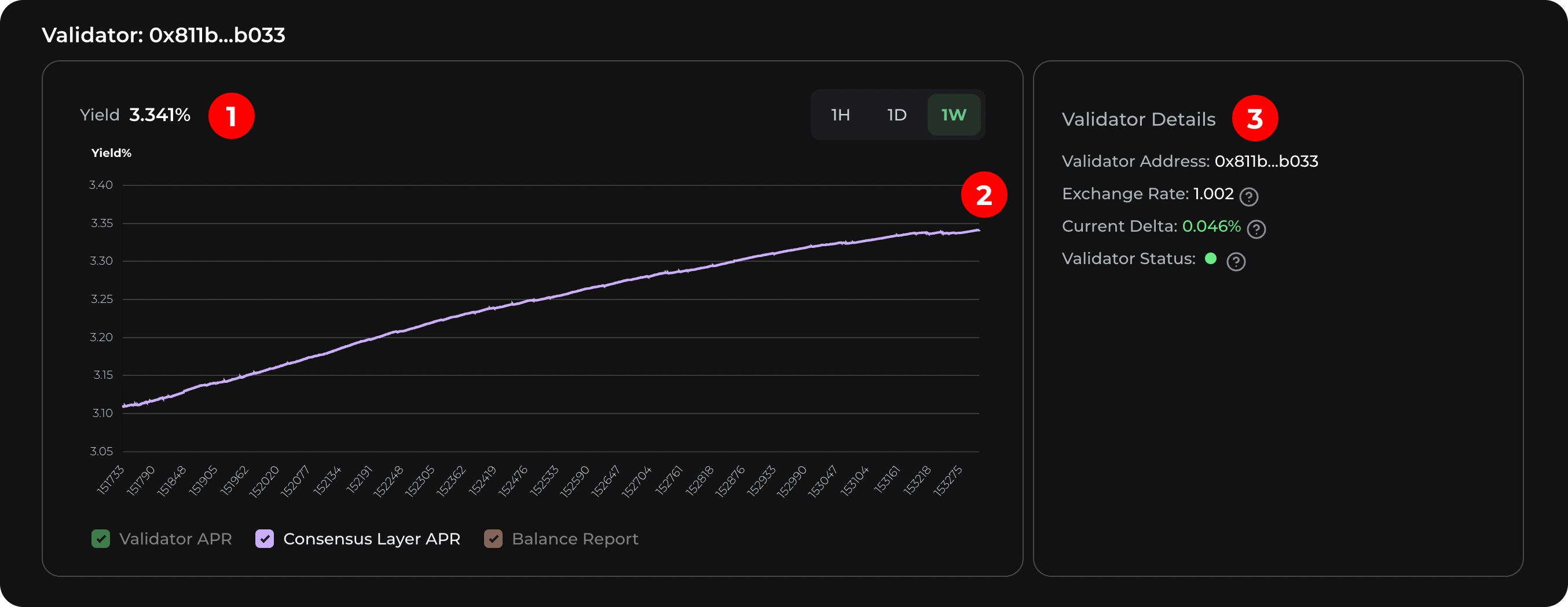

Validator Snapshots

The Validator Snapshots provide in-depth information about each of the validators in the Validator List. This level of scope provides users with a granular view into the status and performance of each individual validator in which their ETH is staked. The information on each of the snapshot dashboards is displayed as follows:

Validator Yield Rate - This displays the APR of dETH within the validator. This is a key metric for monitoring a validator’s yield performance and is updated at the time of a Balance Report.

Validator Yield Rate Chart - The charting tool that displays a validator’s current and past APR, consensus layer APR, and Balance Report dates. This chart is very useful for users who prefer a visual display of their validator’s yield performance over time (it can be viewed in hourly, daily, and weekly timeframes). The interactive boxes at the bottom of the chart allow users to view the validator’s APR, consensus layer APR, and Balance Report dates individually or simultaneously. This provides a multi-layer scope for comparative analysis.

Validator Details:

Validator Address - The validator’s public key.

Exchange Rate - The sum of dETH earned plus the initial 24 dETH balance divided by the initial 24 dETH balance. The exchange rate should never go down.

Exchange Rate = (dETH + 24) / 24

Current Delta - The validator’s current yield rate compared with the yield from its last Balance Report. Positive numbers mean the validator is yielding at a higher rate than the last reported balance. 0 means that the validator hasn’t had an increase or decrease in yield performance since the last Balance Report.

Validator Health Status - The metric that displays the validator’s eligibility for attesting and block building. If the validator status is yellow or red, then it is possible to top up the validator and acquire validator specific SLOT tokens.

- Green= The effective balance is 32 and the active balance is more than 32.

- Yellow= The effective balance is 32 and the active balance between 32 and 31.75.

- Red= The effective balance is less than 32.