Solo Staking FAQ

Answers to common Solo Staking questions.

Q: What is Easy Mode?

A: Easy Mode is solo staking simplified by staking an ETH validator is 60 seconds. Easy Mode simplifies the steps of creating an ETH validator by automating the traditional ETH validator creation process. Easy Mode takes a complex process and deep understanding of the Ethereum CLI and packages it into a 60 second process.

Start staking today with Easy Mode here.

See the staking validator guide [Easy Mode] here.

Q: What is Expert Mode?

A: Expert Mode is the traditional process of creating an ETH validator. Validator owners will follow a similar flow to the Ethereum Launchpad process. Stakehouse offers stakers Easy Mode.

Q: Should I join or create a Stakehouse?

A: Joining a Stakehouse is suggested for most users as it mitigates complexities and is best for individuals. Larger Stakehouses can have additional benefits.

Creating a Stakehouse makes sense for those with large amounts of validators to stake or those who wish to attract a large amount of users. For those looking to coordinate a large amount of stakers can create a Stakehouse LSD Network.

Q: Who is holding my ETH and validator keys?

A: You are. Stakehouse never touches your ETH or validator keys; It is simply a registry which tracks the consensus layer balance of your validator on the execution layer. Users are staking directly with the Ethereum Deposit Contract.

Q: What are BLS keys?

A: BLS keys are digital cryptographic signature keys for performing validator duties on the consensus layer.

Q: Where is my mnemonic phrase?

A: A mnemonic is not required for validator operation. Therefore Easy Mode does not distribute mnemonics. If you require a mnemonic you can stake using Expert Mode.

Q: Can I bring my validator into Stakehouse?

A: No you can not. Validators must be entered into the Stakehouse registry prior to making a 32 ETH deposit. This is for protocol security.

Q: What are the files I was asked to download?

A: These are your validator files - deposit-data file and keystore file. Your keystore file is protected with the password you entered prior to generating the credentials. Keep them safe.

Q: What is the Stakehouse registry?

A: The Stakehouse registry simply tracks the balances of your validator in the consensus layer so that they can be reflected on the execution layer.

Q: Why do I need to setup a node?

A: All validators require a node. The node is what runs the validator on the Ethereum blockchain. Without setting up a node your validator will lose value.

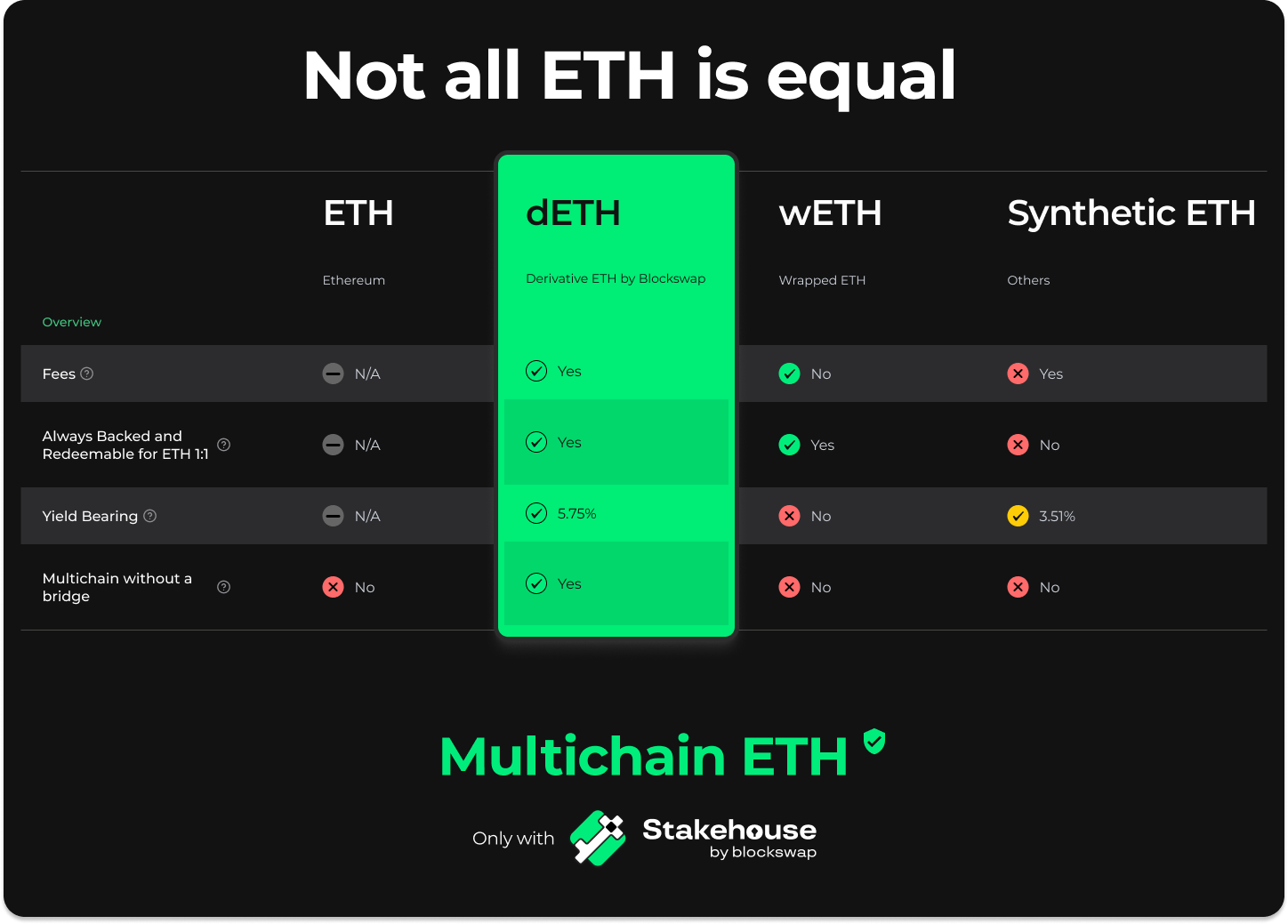

Q: How does dETH maintain its price?

A: dETH is a trustless derivative. In similar fashion to wETH, dETH’s price is maintained via a 1:1 redemption guarantee.

Q: What does Stakehouse cost to use?

A: Stakehouse is free to use and charges 0 commissions.

Q: Who can build on Stakehouse?

A: Anyone, Stakehouse is a permissionless public benefit infrastructure and is intended to be used as a modular middle layer. Learn more at Stakehouse Academy.

Q: Why can't I mint my derivative tokens?

A: Having 32+ ETH in your validator is required to mint derivatives. If you have less than 32 ETH it is likely because you haven’t setup a node or your node is not working properly. If you do have 32 ETH in your validator, then make sure that your validator is recognized by the consensus layer. It can take 24+ hours after staking.

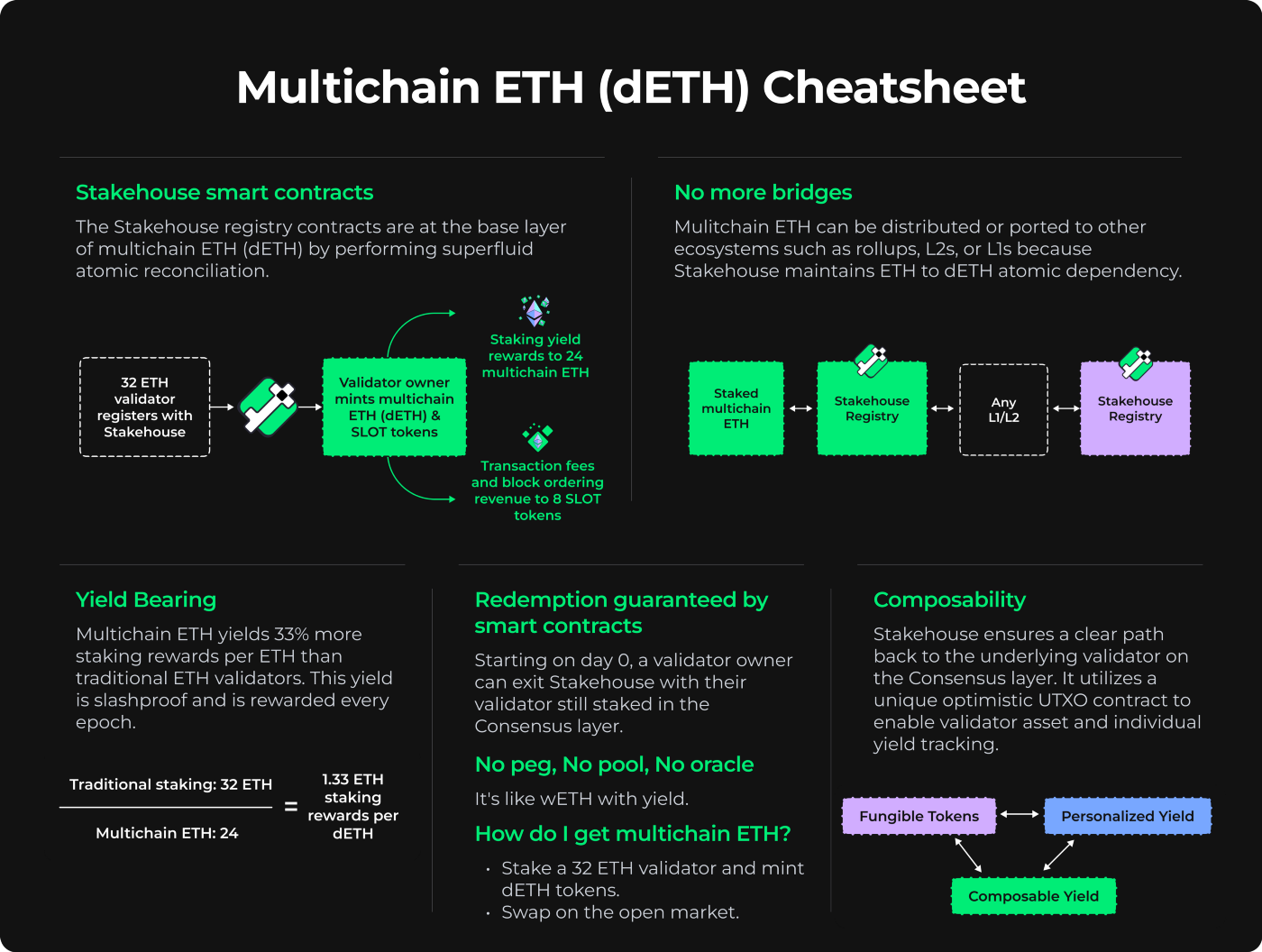

Q. What is multichain composable ETH (dETH)?

A: Multichain ETH is derivative of staked ETH made possible by the Stakehouse registry, smart contract tooling around the Ethereum Deposit Contract. Multichain ETH allows you to have dETH on whatever blockchain you want. Multichain ETH has a truly composable infrastructure, a bridgeless path to any EVM ecosystem, no price peg or pool maintenance, yield singularity, and programmability. These features incentivize security participation and a more connected sustainable crypto future. A key feature that sets multichain ETH apart is atomic dependency (and clear redemption path) to the underlying validator.

Q: Is dETH similar to other liquid staking ETH?

A: No, each dETH can be reconciled to an individual validator. Other liquid staking protocols use a pool and the liquid staking tokens can not be traced back to an individual validator.

Q: What is the contract address for dETH?

A: The token contract address refers to the address location of the actual token contract that manages the logic for the token. Below is dETH’s contract address, you can also check the contract information on etherscan here for goerli and here for mainnet.

0x506C2B850D519065a4005b04b9ceed946A64CB6F - Goerli Testnet

0x3d1e5cf16077f349e999d6b21a4f646e83cd90c5 - Mainnet

Q: Where can I buy dETH and SLOT tokens?

A: Anywhere liquidity pools are available for dETH and utilizing the SDK for SLOT tokens.

Q: How do I get SLOT in my wallet?

A: SLOT tokens are represented in a user's wallet as sETH. Read more on sETH here.

Q: Why do I have to wait to mint my derivatives?

A: The Consensus Layer has to confirm new validators staked on-chain. This is a measure deployed by the Ethereum network. Once your validator is confirmed, validator owners can mint their derivatives. You can check the status of your validator on-chain via the My Profile tab.

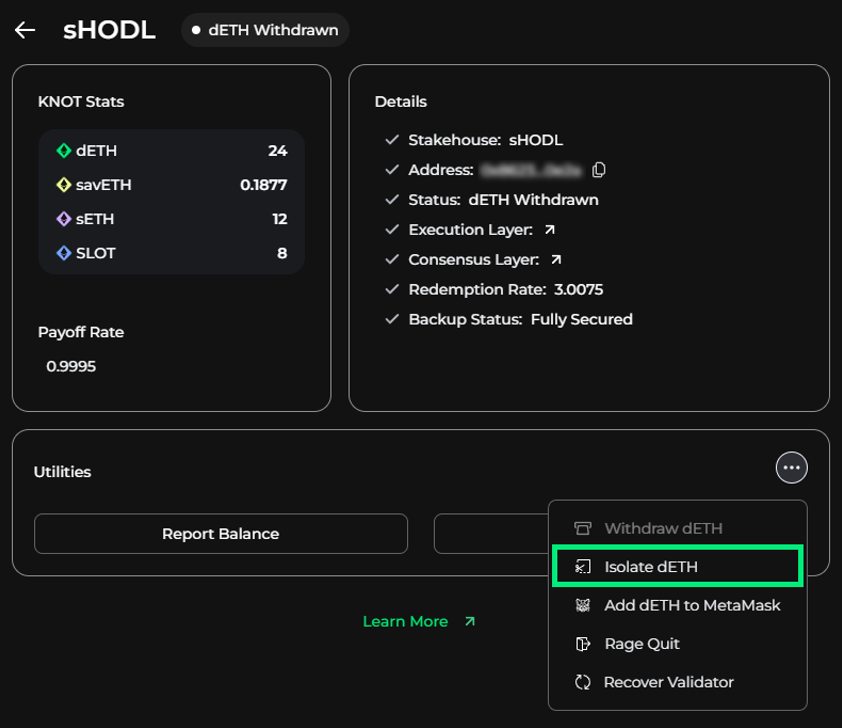

Q: What does isolating dETH do?

Isolating dETH brings your savETH into your savETH index from the Open Index.

To do this head over to the Details page of the validator you would like to isolate dETH.

Q: What are the different statuses?

A:

Indexed: Your savETH tokens are now inside your savETH index.

Minting Available: You are able to join a Stakehouse and mint multichain ETH and validator tokens.

Pending: You are waiting for your validator to be staked in the consensus layer.

Withdrawn: You have withdrawn all your dETH from this validator.

Minted: You have minted 24 dETH and 8 SLOT tokens.

Join the Blockswap Discord for the latest updates, announcements.