dETH vs Synthetics

Why Derivatives?

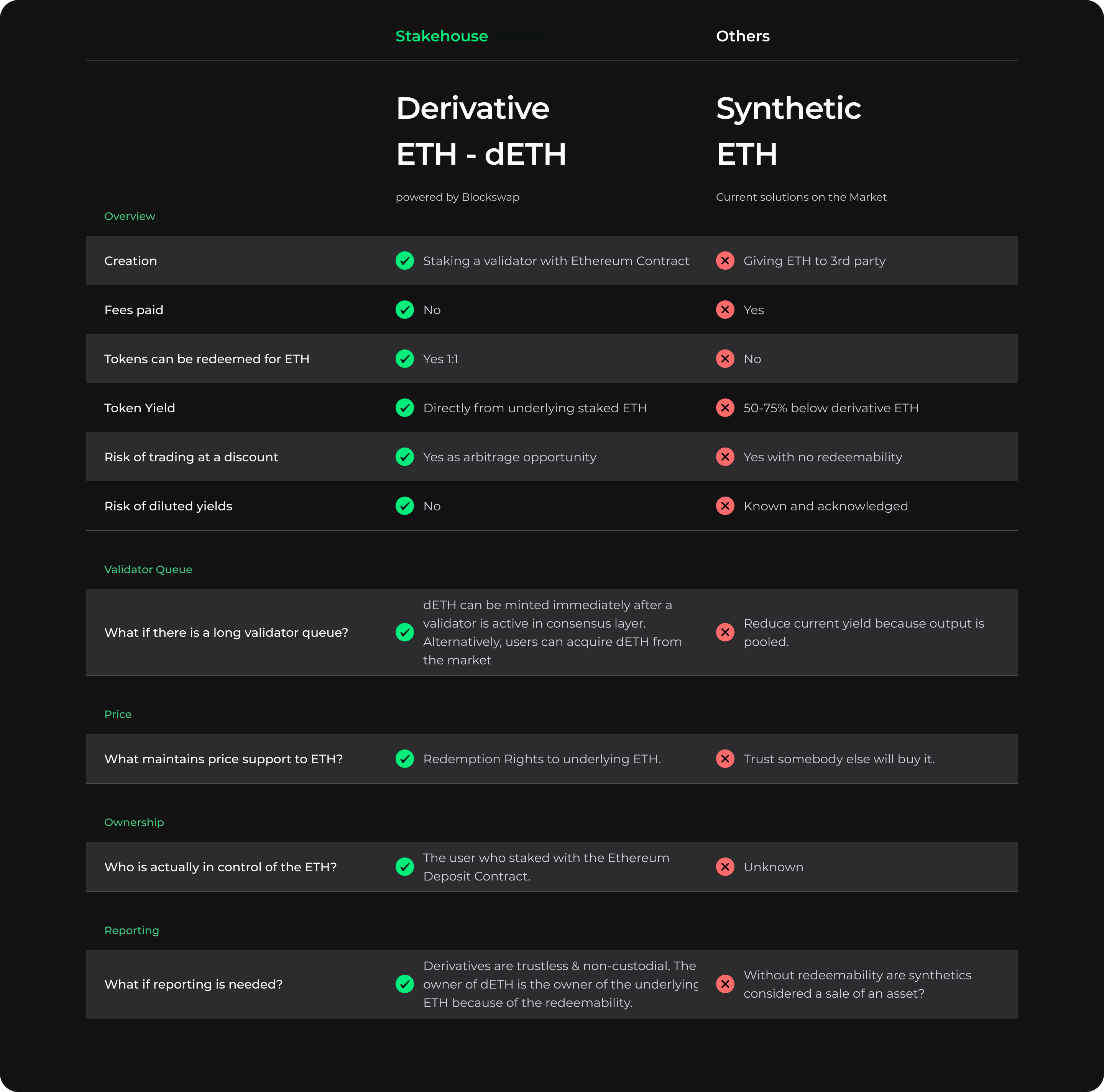

As an alternative to synthetics, derivatives provide a trustless and non-custodial solution. Each person holds their own keys to tokens and validators. All derivative issuances are at the individual level. Tokens are accounted for via a smart contract registry with the underlying staked ETH. Redemption is one of the key differences between synthetics and derivatives. Simple redemption of derivative ETH makes it resilient to most market conditions and has been stress tested for adverse market conditions. Since these derivatives are accounted for via a smart contract registry this enables complete fungibility.