savETH & The Open Index

Overview

To understand the Open Index, it is important to understand that savETH is an accounting token associated with a specific validator. dETH can be minted against the savETH in a validator.

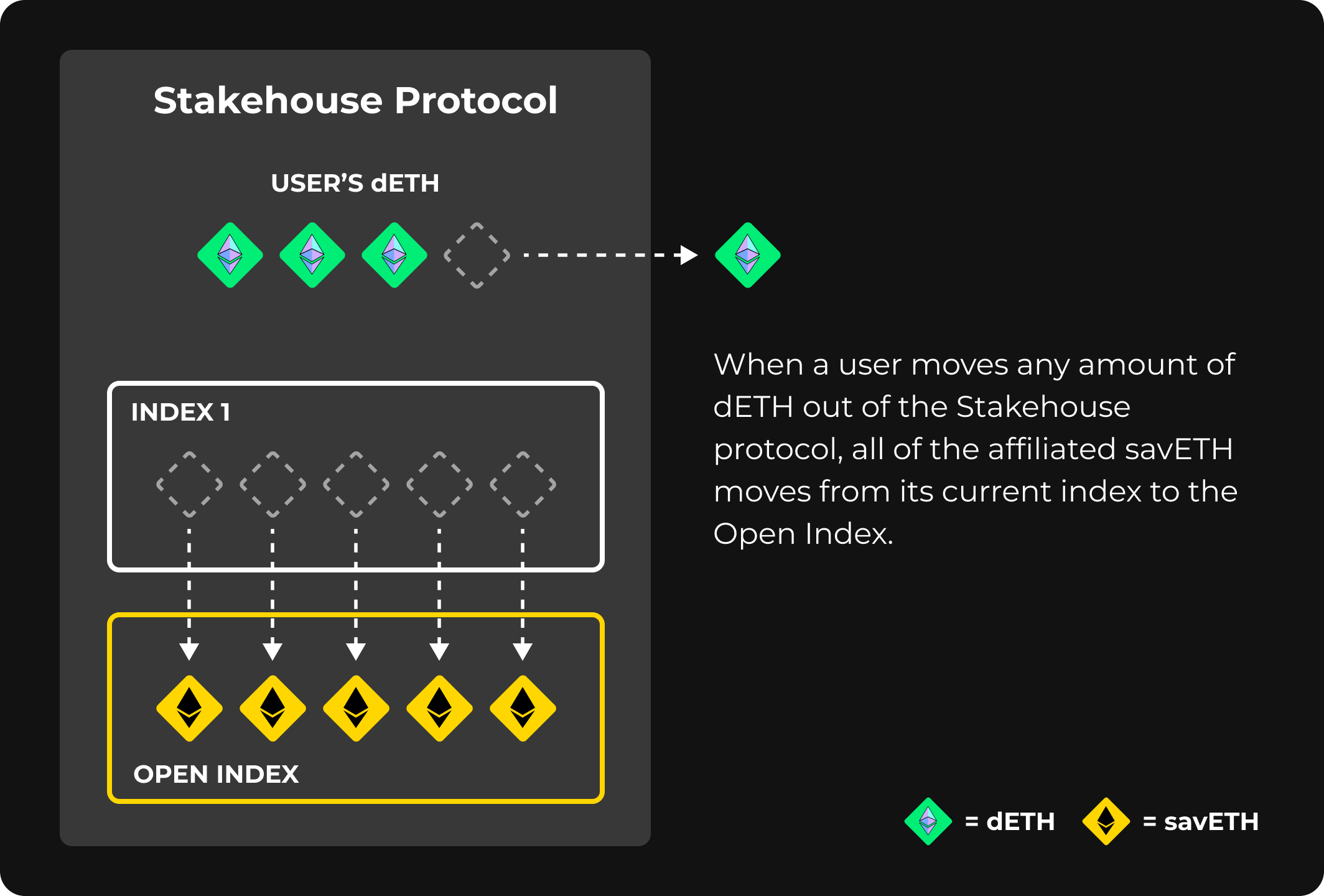

By default, savETH is located in an index associated with a specific wallet (solo staking) or LSD Network (Stakehouse LSD Networks). Once dETH is withdrawn to a user's wallet, the corresponding savETH is moved to the Open Index.

The Open Index holds all the outstanding savETH for dETH located outside of the Stakehouse protocol. savETH is the intra-protocol accounting token for dETH, providing a constant 1:1 representation ratio of the derivative asset.

Since dETH is a liquid staking token, users can transfer it outside of the Stakehouse protocol to trade or use in other DeFi operations to earn alternative yield. When this happens, all of the savETH affiliated with the transferred dETH moves to the Open Index from its current index.

The Open Index can be accessed by anyone looking to curate savETH into their own index or swap KNOTs. To complete this transaction, a user must be holding dETH.

Open Index vs. Other Stakehouse Indexes

The Open Index is different from other indexes in terms of the validators within it. Unlike other savETH indexes, it doesn’t own any validators. Instead, the Open Index only contains validators in which dETH has been withdrawn. These validators transfer to the Open Index from other indexes when this happens.

In Stakehouse Monitoring, users cannot see how many validators are owned by the Open Index, for it doesn’t own any validators. Instead, users can see how many validators are currently in the Open Index. Users can also see the savETH earned by validators when they were in the Open Index.

Validators can join and leave the Open Index as they please.