SLOT Tokens

What are SLOT Tokens?

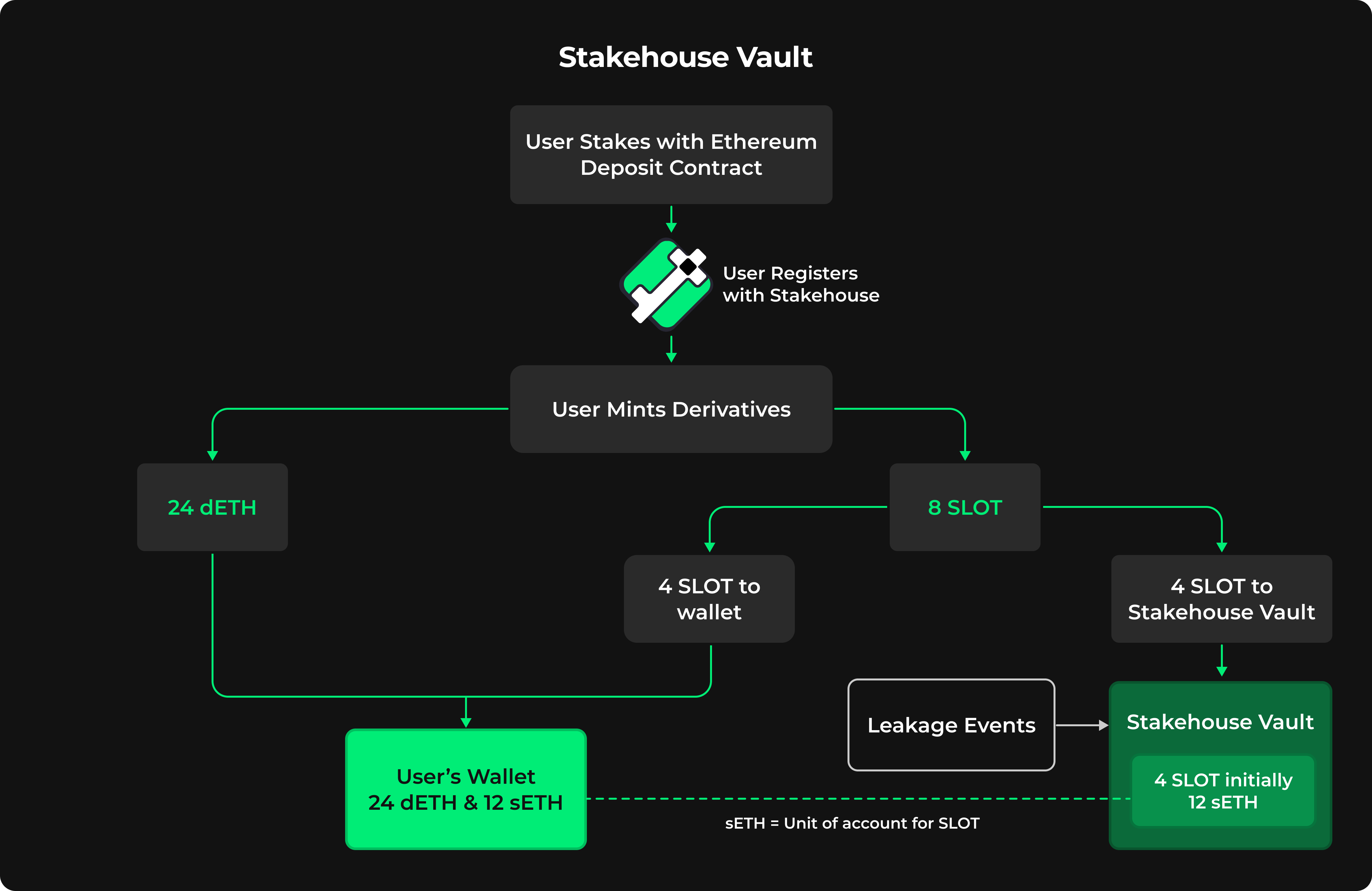

SLOT Tokens are an ERC-20 token representing management rights over how a validator is operated. SLOT Tokens collect network fees such as gas fees, MEV rewards and other validator benefits. When a validator is staked 8 SLOT tokens are minted. 4 SLOT Tokens go to their Stakehouse Vault in the case of a slashing event and 4 SLOT Tokens go directly to the staker’s wallet. SLOT Tokens are slashable but are unbound to yield limits. As a Stakehouse grows, it will have a net positive network effect on yield opportunities for those holding SLOT Tokens.

sETH = SLOT ETH

As dETH increases the value of SLOT increases. SLOT tokens will always remain at 8 tokens per validator. SLOT tokens require a unit of account to calculate their value in relation to dETH. sETH is used to track the increase of dETH in association with the SLOT tokens. Therefore sETH is the liquid representation of SLOT tokens.

Scenario: An increase of dETH results in an increase of sETH. Therefore, there is more sETH and the value of SLOT tokens has increased.

Once a user creates a KNOT they can mint 24 dETH tokens and 8 SLOT tokens. sETH is the unit of account for SLOT tokens.

Stakehouse Vault

When a user mints derivatives of their validator and the underlying staked ETH, the user holds 4 SLOT tokens in their wallet and 4 SLOT tokens in their Stakehouse Vault. They retain full ownership of all SLOT tokens. A Stakehouse Vault is used to enforce validator node management rights in a Stakehouse. Each Stakehouse has its own unique Vault.

Stakehouse SLOT Ownership

All SLOT tokens are under the custody of the user who minted the tokens. If a user decides to remove their validator from a Stakehouse registry, they will still receive the validator in full. All network revenue generated by the validator is awarded to the owner of SLOT tokens both in the vault and in their wallets.

SLOT Token Flow Inside a Stakehouse Vault

The tokens in a Stakehouse Vault are the first tokens at risk of leakage. All SLOT within a Stakehouse are affected by these events. When SLOT tokens are leaked from a Stakehouse Vault, users have the option to top up the validator for themselves or for somebody else.

If a user completely ignores their validator without setting up a node for an extended period of time it may cause a large amount of leakage. This could be the result of a rational actor using Stakehouse to accrue short-term gains through Compound staking, and are not interested in performing validator duties. The result could be another user topping up their validator for them, and acquiring SLOT tokens.